You want to be able to fast track your loan approval to access cash for life changing opportunities.

A fast loan approval is every one’s dream but very few people’s reality. Let us explain why.

Many people do not understand how maintaining good credit works. They are not aware of the responsibility that comes with taking on more debt. It is easy to get swept off your feet by an enticing offer to sign for more credit. But if you understand what it requires to remain creditworthy – you may think again.

You see, to be able to maintain healthy credit, you have to understand how to balance your credit to keep your score high.

Your credit score is your passport to get your loan approved. It is the first thing that lenders look at before they consider granting you any form of loan. Creditors use your credit score to see what level of risk you are and if you are credit worthy or not. The better your score, the higher your chances of obtaining a new loan. A good credit score will also ensure that you’re granted better interest rates.

It’s is always important that you work on your credit score before applying for any credit. Banks are cautious when it comes to granting new credit. If you do not make a good first impression you may not qualify for the loan you need. The good news is that we are here to help you and we have 8 tips that you can use to keep your credit score in check 🙂

Fast track your loan approval through maintaining a good credit score

1. Get a copy of your credit record. Before you can begin to fix your credit score, you must know where you are standing on the credit ladder. 80% of Credit reports incorrect so this is a good way to check your credit report and fix any errors.

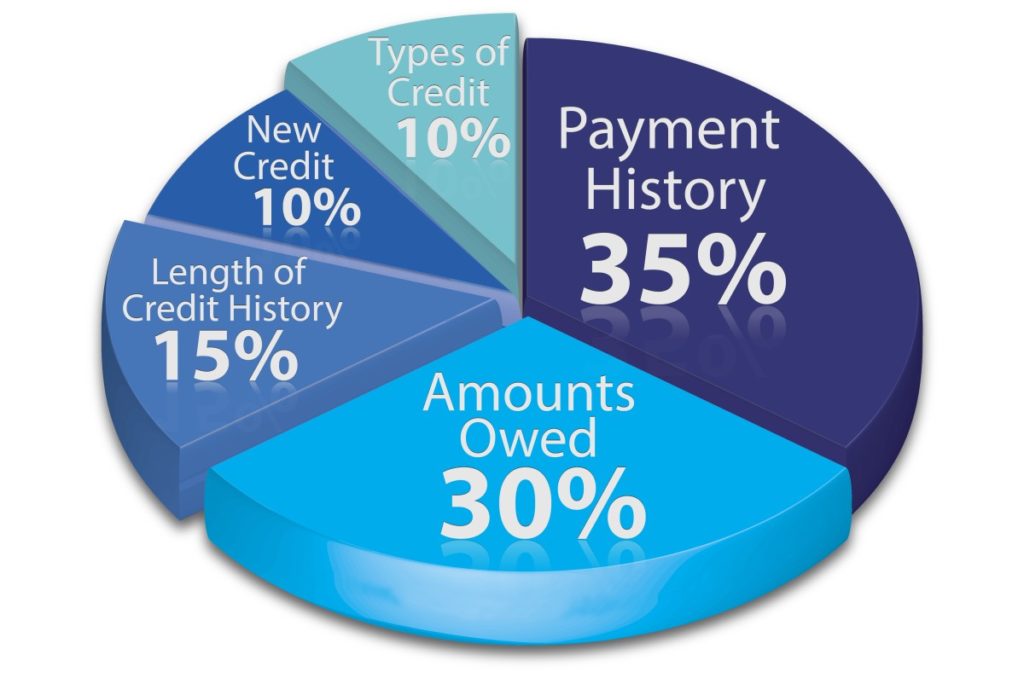

2. Pay your accounts on time. Your payment history makes up around 35% of your credit score. It is thus important that you pay your accounts on time. If you can’t pay on time, the right thing to do is contact your creditors and explain your situation. It’s better to contact them first before they contact you.

3. Keep you late payments to 30 days or less. Anyone can find themselves in a financial bind, and not ball to pay all their bills on time. Hey, it happens. If an unavoidable late payment scenario happens to you, keep your late payments to 30 days. Many creditors don’t report 30-day late payments to credit reporting agencies. But all report payments that are 60 days late.

4. Close unused accounts. Less accounts lowers your risk to creditors.

5. Limit Credit checks. Every time that someone does a credit check on you, it has a negative impact on your score. You should avoid applying for credit while you are working on your credit score.

6. Don’t take on too much debt. Keep your debt to the least amount and don’t try applying for more debt while you are still paying off current debt. Your debt payments should be no more than one third of your gross salary.

7. Avoid court orders on your name. Judgments and garnishee orders can do a lot of damage to your credit score and they take years to delete.

8. Focus on your credit card bills first. Credit card interest is the most expensive interest. Its thus best to focus on getting your credit card payments down first. A choice to focus on credit card debt is a great way to boost your credit score. Try paying more than the installment reduce your card balance to help you maintain a good score.

We hope you find these tips useful to repair your credit score. The sooner you start working at it, the quicker you will be able to become credit worthy again.

Use your good credit score to Fast track your loan approval so you can invest in your future!

Connect with us

Follow us on Facebook: https://www.facebook.com/premierfinanceza

Sign up for loan and finance guidance here: https://jkmsloans.co.za/register-now/